While prequalification doesn’t contain distributing a formal application, you should expect to supply own information such as your revenue.

After getting a list of doable lenders, it’s a smart idea to find out if they provide prequalification, which allows you to see your likely charges and conditions without the need of triggering a tough credit score inquiry.

While this will routinely be eradicated by some lenders, it’s worthwhile to keep watch over your basic principle and residential’s worth then method your lender to discover if this can be faraway from your monthly payment.

Even so, this option has a few specifications. Very first, there must be ample equity to qualify for a house loan refinance and you need to be prepared to pay back closing charges and some supplemental fees.

The Payment Calculator can assist type out the fantastic aspects of this sort of things to consider. It can be employed when selecting between financing options for a car, that may vary from 12 months to ninety six months intervals. Regardless that numerous automobile prospective buyers will be tempted to go ahead and take longest solution that brings about the bottom regular payment, the shortest time period commonly ends in the lowest overall paid out for the vehicle (desire + principal).

Truliant can empower you With all the information, talent and instruments to beat your financial debt. Better yet: we will provide advice so you can master to higher avoid credit card debt Down the road.

A loan is a contract in between a borrower as well as a lender through which the borrower receives an amount of money (principal) that they are obligated to pay for back in the future.

Use desire rate in order to determine loan specifics with no addition of other prices. To uncover check here the entire cost of the loan, use APR. The advertised APR typically supplies far more exact loan particulars.

Nonetheless, borrowers Usually must pay out refinancing service fees upfront. These expenses can be quite higher. Be certain to evaluate the pluses and minuses prior to making the refinancing choice.

Your potential curiosity fee, the size with the loan and any service fees will have an effect on the overall Price. We endorse utilizing a loan calculator to find out the amount you might end up paying more than the life of the loan.

HELOC A HELOC is a variable-charge line of credit history that allows you to borrow money for the established period of time and repay them later on.

If there isn't a prepayment penalty concerned, any more money going in direction of a loan might be utilized to lessen the principal amount thanks. This may quicken some time in which the principal because of last but not least reaches zero and lowers the level of curiosity due due to smaller sized principal sum that is certainly owed.

Best Egg gives aggressive premiums for all those with fantastic or excellent credit score. There won't be any prepayment penalties over the loan, but you’ll must fork out a one-time origination charge.

For those who have some combination of very good to superb credit history, a minimal personal debt-to-revenue ratio, continuous revenue and belongings, you are able to likely qualify for many different types of loans. Use loan calculators to answer your inquiries and help you Assess lenders so you can get the most effective loan on your economical predicament.

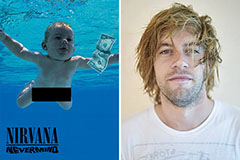

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!